Just above equatorial Africa, west of Nigeria, there is a country by the name of Benin. Everyone knows that. Thank my ignorance, I didn’t. That changed quickly when I met this guy who drove the very best Uber Lyft I have travelled in. Most people, like little monarchs, hop on the back seat of a ride-share. Not me. I insist on sitting shotgun and after reading this, hopefully, you shall too. This wasn’t just any driver. He was shuttling people to and fro the Berkshire conference. He doesn’t need the ride-share money. He is there for the wealth of knowledge and the stock tips. My fascination for the lives of uber drivers is widely documented but this post is not about them.

At this juncture, allow me to remind you, Peter Lynch said that people do more research for the new refrigerator, new car, for an upcoming trip but will take stock tip from strangers they meet on a bus and invest half their life savings before sunset. I have often committed that crime (thinking BABA) so reader caution advised. Also, this piece is designed to cater to attention spans of 2025. Meandering is encouraged.

For the past 3 years, I have been making a trip to Omaha, and almost always I am at a loss of words to describe what I do there to anyone who cares to ask. First year, I saw a 99 year old dole out zingers for four hours straight. Second year, I participated in the longest standing ovation as a tribute to personal hero and this year, I saw a business legend step down in front of some forty thousand people as a passing remark. Everyone, including his successor, was surprised.

Historically, what happened in Omaha, stayed in Omaha. Presently, it is spammed all across LinkedIn and Youtube. This year, I went around asking folks, what were their top holdings or highest conviction bets, and why. I have collated those here. Keep in mind these folks are value investing enthusiasts with their own biases and limitations. I do not know most of them. None of these are an endorsement. Threat these as a mere catalogue to research further at best. Please don’t make any buy, sell or hold decisions based on this writeup. I certainly, am not.

With that, meet Patricia. Patria Investments holdings (PAX) is quietly becoming the go-to player in Latin America’s private markets. While everyone else is chasing the usual suspects, Patria’s been busy growing its assets under management at a pace that’s hard to ignore. PAX is perfectly positioned to keep collecting steady fees and cashing in on IPOs as more local companies go public to support on-shoring and as more and more jobs move back to Latin 'Murica . On the downside, since these are private investments, we have to take their numbers at face value, with no auditable trail. The dividend also went down from 8% to <5%, they diluted a bit and publicly traded PAX units lack any meaningful voting rights. So snowbird your investments with caution and know that the stock is down a third from its IPO price.

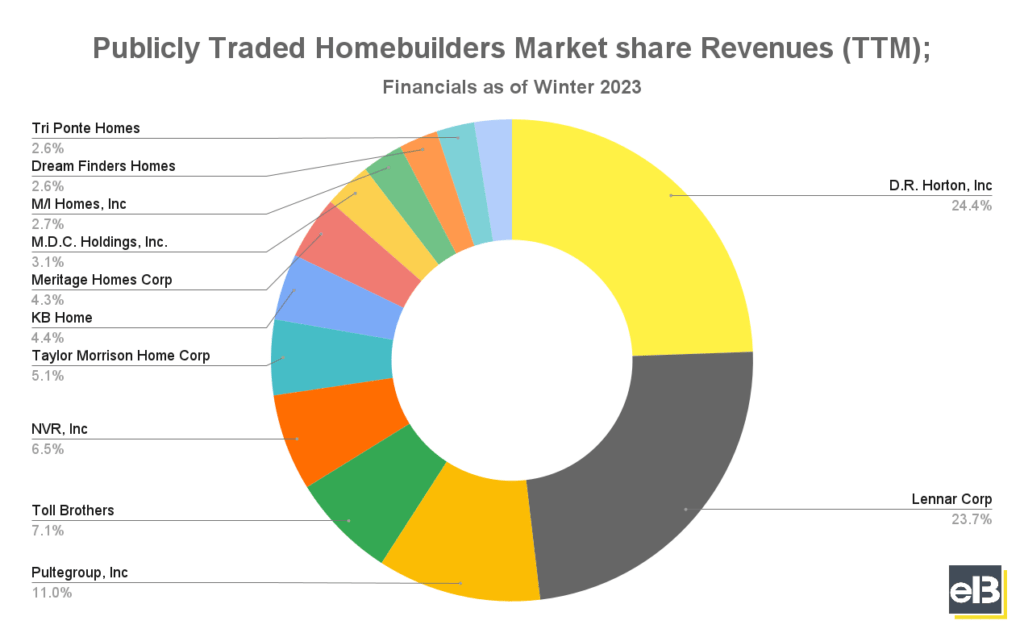

Next, Tri Pointe Homes (TPH) is building more than houses-they’re constructing profits on America’s hottest real estate trends. With millennials finally trading rent for mortgages and housing supply still tighter than your uncle’s pants after a holiday meal, TPH is perfectly placed to cash in. Their leadership team has survived every housing rollercoaster, so they know how to buy land smart, build efficiently, and keep margins healthy. Before you jump in consider some counter stats, in Q1 2025, home deliveries dropped 25% year-over-year, revenue fell 22%, and new home orders sank 32%, all signaling weaker demand and a shrinking backlog. While margins improved, net income still slid 35% and management expects further delivery declines for the full year. PHM (Pultegroup) is a similar story but is still one of the lowest P/Es in the S&P. I may be biased as I have dabbled with BLDR in the past with some meaningful change.

If you are already priced out of your region for mortgage, you can always take the other side of the table and be a landlord of New York multi-family homes. Clipper Realty (CLPR) is quietly cashing rent checks while the New York skyline does the heavy lifting. With residential revenues up nearly 12% and new leases commanding almost 10% more than old ones, CLPR is squeezing more juice from every square foot. Their Dean Street project is ahead of schedule, and a pending property sale is set to drop $12 million in fresh cash into the kitty1. Toss in a 36% jump in AFFO (Adjusted Funds From Operations, a key measure of REITs (Real Estate Investment Trusts)) and a steady dividend, and you’ve got a landlord that’s not just surviving the city-that’s thriving on it. In a town where rent is always due, CLPR keeps collecting.

If real estate is not your jam, maybe buy some title insurance? Investors Title Company (ITIC) is the quiet powerhouse of title insurance, raking in premiums every time a property changes hands-while rarely having to pay out. With a fortress balance sheet, nimble operations, and a knack for growing market share in a sleepy but essential niche, ITIC turns real estate paperwork into a profit printing press. In a world of financial drama, ITIC’s business is delightfully boring-and that’s exactly why it works. On the flip side, here is a direct quote from a critic for not biting, “Price. Slow growth. Also title insurance is something that is low value to your customer. Non reoccurring. Commoditized. Tech bros have been saying it’s going to be disrupted for over a decade and it hasn’t happened yet to my knowledge.”

Before we move away from real-estate, let me tell you that no software engineer wakes up and dreams of building a software for construction. Procore Technologies (PCOR) is laying the digital foundation for the construction industry’s future. While rivals are stuck in the mud with spreadsheets and siloed workflows, Procore’s cloud platform connects everyone from owners to subcontractors-turning chaos into collaboration and delays into dollars. With revenue growth still pouring in and construction’s digital transformation just getting started, Procore is the toolbelt you want to own as the industry builds smarter, not just bigger. Ask any software engineer you know, they are not building software for building buildings. ProCore is.

Let’s look at a bank (or two). East West Bancorp (EWBC) isn’t your average regional bank-it’s the financial bridge between East and West. Stereotypes exist for a reason and one good thing about Asians is that they save a lot. EWBC turning cross-border business into bottom-line gold. Their loan books have very low defaults and their interests are low but they offer their customers cross-border services. While rivals sweat over shrinking margins, EWBC keeps growing loans, boosting deposits, and flexing a rock-solid balance sheet. With a loyal, entrepreneurial customer base and a knack for navigating both U.S. and Asian markets, EWBC is positioned to thrive where others stall. Careful though, banks are not for everyone, interest rates are unpredictable and this one depends on Sino-American relations. So there is that.

If investing in China does not bother you, may I introduce you to a Georgian bank? (I mean the country, not the state.) TBC Bank Group (TBCG) is Georgia’s financial powerhouse with its foot on the gas and an eye on new horizons. Already dominating at home, trading in single digit multiples, ~5% dividend, trading on the London stock exchange, TBC is now exporting its digital banking magic to another fast-growing market of, wait for it, Uzbekistan. With a tech-savvy approach, a fortress balance sheet, and market share most banks can only dream of, TBC isn’t just banking on Georgia-it’s building a regional empire. The Uzbeki expansion is led by a Brit, Oliver Hughes, a legend in the Fintech world, who ran Visa operations in Russia, was the CEO of Tinkoff Bank. (T-Bank is a big name in Russia and one of the best run and digitally progressive banks of the world. Again, I maybe biased as I own a little of Nu bank, which was inspired by the Tinkoff model.) You can listen to this heavy Brit voice talk about the future of banking in the link below.

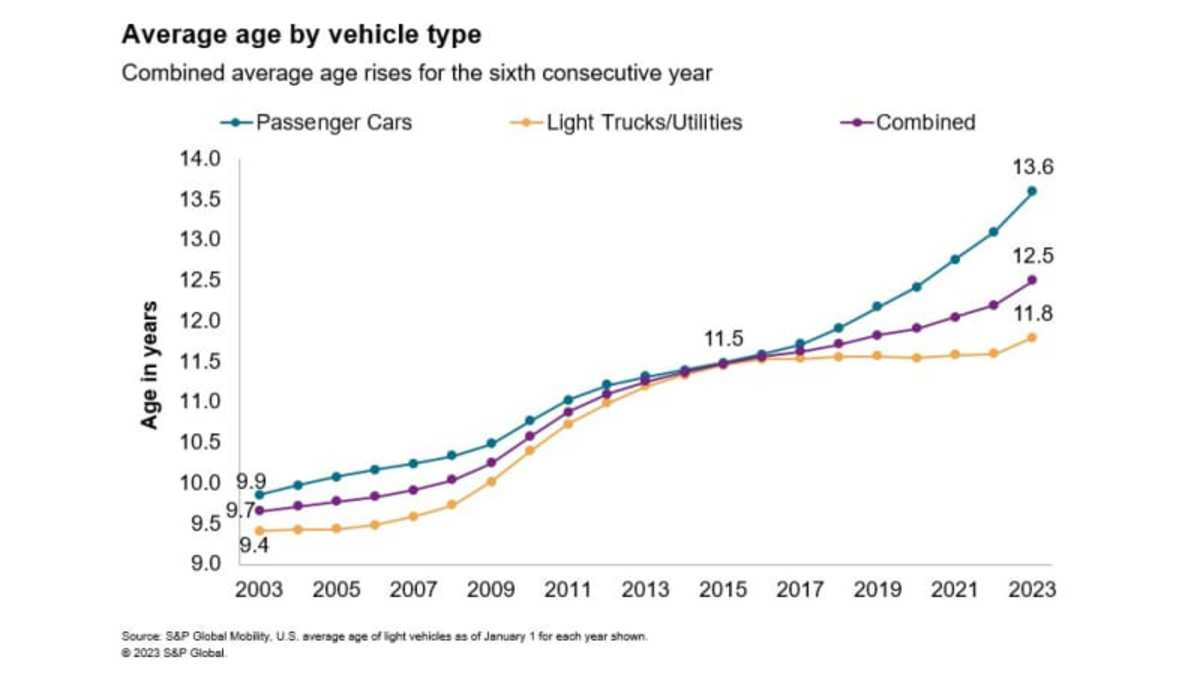

Let’s talk about cars. I don’t own one, which makes me perfectly qualified to talk about these motor chariots. Cars are getting expensive because the parts enter and exit the country a couple of times and will make these $4-5k more expensive on average with the ongoing tariff discussions. This will make used car dealers and servicing companies a little more valuable.

Enter DRVN. Driven Brands (DRVN) is the pit crew of American car care, quietly rolling up mom-and-pop shops into a nationwide powerhouse. Take 5 Oil Change, a crown jewel of Driven Brands, is redefining the oil change game with its signature “stay-in-your-car” 10-minute service. Since Driven Brands acquired it in 2016, Take 5 has exploded from fewer than 50 locations to more than 1,100 across 42 states and Canada, with plans to double that again in the next four years. The secret sauce? A drive-thru model so fast and convenient, you barely have time to check the gram before you’re done. One reason to stay away is if you think EVs will take over the world and range anxiety will vanish shortly. In that case you can clone Mohnish and buy the dealerships, LAD (Lithia motors) and ABG (Asbury motors). No wait you can’t, most of their revenues also come from servicing. You also cannot buy VVV (Valvoline) lubricants. Well, why don’t you short these instead, if you are so sure about the EVs? Below is a chart to consume before you do that.

Ready to look into a hospital network? HCA Healthcare (HCA) is the hospital heavyweight that keeps getting stronger, no matter what the economy throws its way. With a network so big it’s practically a healthcare city, HCA fills beds, grows revenue, and flexes pricing power while rivals scramble for staff and scale. As America ages and demand for care climbs, HCA’s efficient playbook and deep pockets mean it can invest, expand, and outlast the competition. Bottom line: HCA is the rare stock that thrives whether the market’s feeling sick or healthy-making it a prescription for steady, long-term gains. Did I mention Americans are growing older? It is sad they die sooner, HCA could have had a longer CLTV :)

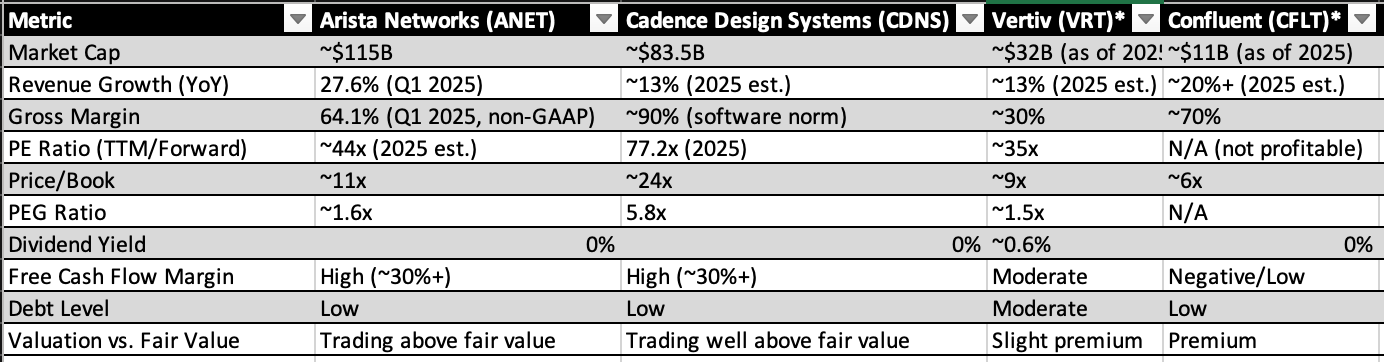

Occasionally there were some AI mentions that were not Nvidia. Personally, these valuations are still very expensive for me but according to some folks that came to Omaha, AI is set to supercharge Arista Networks (ANET), Confluent (CFLT), Vertiv (VRT), CoreWeave (CRWV), and Cadence Design Systems (CDNS) by amplifying their core strengths and unlocking new growth engines. Quick table and some notes below. Let me know if there is any appetite to dive deeper into any of these.

Arista Networks AI’s insatiable demand for data and low-latency networking plays directly into Arista’s wheelhouse. Their AI-optimized Ethernet systems and software-like the Etherlink portfolio and EOS Smart AI Suite-enable massive, high-speed, and reliable data flows needed for AI clusters. Features such as AI job-centric observability, advanced load balancing, and deep telemetry powered by machine learning make Arista’s networking indispensable for hyperscale AI deployments.

Confluent As the backbone for real-time data streaming, Confluent benefits from AI’s hunger for fresh, high-velocity data. AI applications need constant, reliable streams of data for training and inference, and Confluent’s cloud-native Kafka platform delivers just that. This cements Confluent as a critical infrastructure provider for AI-driven enterprises (inference based on industry trends).

Vertiv AI workloads are pushing data center power and cooling needs to new extremes. Vertiv’s advanced power, thermal management, and liquid cooling solutions are essential for keeping AI hardware running efficiently and sustainably. As AI data centers scale, Vertiv’s role in enabling high-density, energy-efficient infrastructure becomes even more vital (supported by CoreWeave’s emphasis on liquid cooling 2).

CoreWeave Purpose-built for AI, CoreWeave’s cloud platform offers ultra-fast, resilient, and scalable GPU infrastructure. Their expertise in InfiniBand networking, liquid cooling, and bare-metal Kubernetes clusters means they can support the most demanding AI model training and deployment at scale. Massive deals, like their $11.9 billion agreement with OpenAI, highlight their central role in powering next-gen AI innovation 3.

Cadence Design Systems Cadence is using AI to revolutionize electronic and system design. By integrating AI and accelerated computing (with partners like NVIDIA), Cadence enables faster, more accurate simulations and optimizations, slashing design times for complex chips and systems. Their AI-driven platforms are already delivering breakthroughs in engineering productivity and digital twin technology, making Cadence a linchpin for the next wave of AI-powered hardware innovation

We can touch a little on software companies before we wind this up. I want to stress that I am not passing any moral judgement on the picks. Some of my friends happen to work at Meta. I do not go quoting stats on teen suicides to them. Sometimes the least you can offer to people is the kindness of letting them keep their innocence through ignorance. Also, I do not hold this stock. With that said, let’s talk about online gambling.

Evolution Gaming (STO: EVO) is the casino kingpin of the digital age-dealing cards, spinning wheels, and minting cash while most of the competition is still shuffling chips. Even after a rough Q1 2025 (thanks to cyberattacks in Asia and regulatory curveballs in Europe), Evolution keeps the house edge: massive margins, a fortress balance sheet, and a relentless pipeline of new games. The market’s recent sell-off looks like a classic overreaction-because when you’re the table everyone wants to play at, a cold streak is just another hand.

While I don’t look at companies that are loss making wanted to mention Braze. Braze (BRZE) is the secret sauce behind those perfectly timed app notifications and emails you actually want to open. While most brands still spam, Braze helps companies talk to their customers like humans-using smart, AI-powered messaging across every channel. The numbers back it up: revenue jumped 26% last year to $593 million, losses shrank by 20%. With Braze’s recent leap into AI and a new acquisition to supercharge personalized marketing, some folks are optimistic. For me, it is too pricey. But good customer retention and rapid margin expansion definitely detected.

Speaking of more pricey, Toast (TOST) is the tech chef behind your favorite restaurant’s smooth service, serving up cloud-based point-of-sale and payment tools that keep orders flying and customers happy. In Q1 2025, Toast added 6,000+ new locations (now at 140,000), landed its biggest deal ever with Applebee’s, and flipped from red to black with $56 million in net income. Revenue sizzled 24% higher, annual recurring revenue hit $1.7 billion (up 31%), and free cash flow turned positive-proof that Toast isn’t just growing, it’s finally making money on every plate. With AI-powered tools and a growing global footprint, Toast is cooking up a recipe for long-term success in the $40 billion restaurant tech market. They had their first profitable quarter so there is that. Still it will take 166 years to break even with their current earnings.

Finally, Roblox (RBLX), was the favorite of my roommate and they have tripled their bet but I still don’t see how adults can take this any seriously. Roblox (RBLX) is the digital playground where millions of kids-and plenty of adults-build, play, and spend real money on virtual fun. Despite some growing pains, Roblox keeps leveling up: daily active users hit 77.7 million in Q1 2025 (up 17%), bookings jumped 19% to $923 million, and the platform is expanding fast in markets like Japan and Brazil. With new AI-powered creation tools, Roblox is making it even easier for anyone to build the next viral game. Monetization keeps improving, and while profits are still a work in progress, Roblox is cashing in on the future of social gaming and the metaverse.

There are some other niche Swedish names like Addtec, or media companies that own the Vegas sphere (SPHR), or the Indian company that is a back-office of most local mutual funds (CAMS) or a TV company in Mexico that also owns a soccer team (with interesting tail winds like the world cup just happens to be next year with Mexico as the co-host and this company as the FIFA streaming partner). There is a lot to fish from if you have exhausted all the names above. Why don’t you buy a BRK share and accompany me at the event next year? We can grow this list together?

We can stand in line at 3am and use Google translate to chat with a young Chinese couple that travelled to be there or can talk about how ethical it is for a dictator to confiscate beer operations you invested in? Enjoy $1 dilly bars of DairyQueen? Buy Brooks shoes at a discount? Or get pics with the celebs that casually show up? You can always read about these here but language is tricky and my writing is poor. There always be some gap between knowing a path and walking a path. So see you there? First Saturday of every May?

More posts on detailed analysis below.

Reasons NOT to own what I own - Part I - BABA

June 5, 2024

This is an attempt to articulate the rationale behind all my current holdings starting with my oldest, largest and at the time of this writing, my least successful holding by all measures… BABA. Reader skepticism is encouraged as the author presents a biased view of his favorites and this writeup is NOT to be construed as a BUY, SELL or HOLD decision. I…

Reasons NOT to own what I own - Part II - Tencent

June 11, 2024

Part of my challenge is adapting to all other humans. Another part is to sound dumb and repetitive as I remind you all that reader skepticism of this article is heavily encouraged as the author presents a biased view of his favorites and this writeup is NOT to be construed as a BUY, SELL or HOLD decision. I am not your tax, accounting, investment or fin…

Reasons NOT to own what I own - Part III - Turkish Insurance companies

June 18, 2024

My closest friends do not trust me with the choice of ice cream toppings and never risk saying “Surprise ME!!” as they look for parking. You shouldn’t be looking for any insights from such a guy. Reader skepticism is highly encouraged as the author presents a biased view of his favorites and this writeup is NOT to be construed as a BUY, SELL or HOLD dec…

This past weekend... was "Slick, yo!"

May is my favorite month. Whoever says it is difficult to make friends after 20s has not travelled to be at a conference in a subject that they deeply care about. Few people travel to conferences. Fewer have subjects they care about. These people die lonely. My goal is to find folks who are the opposite. For me, a good place to do this is on the first S…

Thanks for sharing ! Well covered