Reasons NOT to own what I own - Part I - BABA

Not really stock advice, just collation of my learnings

This is an attempt to articulate the rationale behind all my current holdings starting with my oldest, largest and at the time of this writing, my least successful holding by all measures… BABA. Reader skepticism is encouraged as the author presents a biased view of his favorites and this writeup is NOT to be construed as a BUY, SELL or HOLD decision. I am not your tax, accounting, investment or financial advisor. I am definitely not your priest nor your fortune teller.

Reason I - Misunderstood Culture and Geopolitics

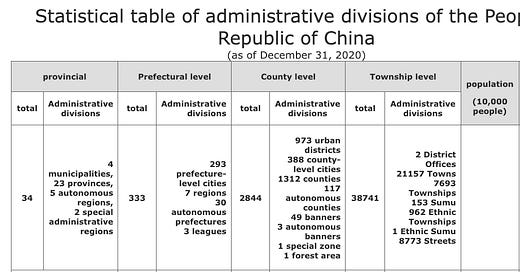

While I do not claim to understand either side, as a neutral party, I can definitely see that both stances are misunderstood. I would like to point you to the work of Keyu Jin, a Chinese economist, an associate professor of economics at the London School of Economics, and a World Economic Forum Young Global Leader, specializing in international macroeconomics and the Chinese economy. Her book “The New China Playbook: Beyond Socialism & Capitalism” covers a comprehensive exploration of China’s unique economic system, its evolution, and its impact on the global economy. One key point the author makes is that the politics of China is more nuanced than most people think with local divisions boasting greater autonomy than the West may have been led to believe.

From my vantage point, China is a culture as old as the one I hail from and the Western view is limited to a few centuries. Take humans for example, a great majority did not live past their mid-30s and hence it is very difficult for most young humans to strategize for decade-horizons. If you allow me to draw parallels, few cultures have been this resilient over centuries. This may very well be the best example of Taleb’s Lindy effect at play.

On the flip side, most agrarian economies, including China, were gerontocracies. This made perfect sense, when a grandparent had seen more crop seasons than the parents, who in turn had seen more rainfalls and floods on their farms than their adolescent children. This accompanied by Confucian philosophy did not accommodate for the rise of technology seen in the past century, where the equation was flipped. Broadly speaking, technocracy or obsoletion of skill set within generations is a fairly new concept in humankind.

What has that got anything to do with geopolitics? That is a good question, I will respond with, “How do you expect a kung-fu master to behave when confronted with the smart kid who invented the machine gun?” There is no playbook, but for a little while, the kid with the machine gun can throw a few tantrums and have their way until the Kung-fu master catches up. The kid can’t kill the master. That would cut the supply of machinery and electrical equipment (24%), most household items (19%), metals (10%), textiles (8%), and plastics or rubbers (7%) for the kid.

This complicates things. That makes it wise to stay out of the region. An intelligent follow-up from a neutral, global observer who knows of prisoner’s dilemma would ask “which one? both?”

Reason II - Misunderstood ownership structure

Let us dive into the world of Alibaba (BABA) and its Variable Interest Entity (VIE) structure, which is common to several Chinese equities that trade in US stock exchanges. But first, let’s imagine Alibaba as a giant panda 🐼. This panda lives in the vast bamboo forest of China’s economy. Now, pandas are native to China, but people all over the world love them and want to invest in their well-being. That’s where the VIE structure comes in.

The VIE structure is like a mirror that reflects the panda to the outside world. When foreign investors buy shares in Alibaba, they’re actually buying shares in a shell company that has a contractual right to the profits of the actual Alibaba business. It’s like adopting a panda: you don’t actually own the panda, but you contribute to its care and get updates on its progress. Below is the image of the VIE structure from the SEC website:

Now, this mirror (VIE structure) is not without its smudges and cracks. Here are some of the risks:

Regulatory Risk: The Chinese government could decide they don’t like these mirrors and make changes to the regulations around VIEs. It’s like if the panda reserve decided to stop the adoption program.

Ownership Risk: Since foreign investors don’t actually own shares in the real Alibaba, there’s a risk that the contractual agreements could be invalidated. Imagine if the mirror broke and you couldn’t see the panda anymore.

Delisting Risk: There’s also a risk that Alibaba could be delisted from American exchanges due to these complex structures. That would be like if the panda reserve suddenly became inaccessible.

That in itself should deter you from owning this company. Though some counters to consider are that BABA has ALWAYS had a VIE structure. Past prominent owners of Alibaba ADRs included big names like David Tepper’s Appaloosa Management, Michael Burry’s Scion Asset Management, and Charlie Munger’s Daily Journal Corp1.

As for the current scenario, SoftBank, once the largest shareholder, has largely cleared its ownership in Alibaba1. However, some of the current prominent owners include Vanguard PRIMECAP Fund, Fidelity Funds SICAV - Global Technology Fund, and UBS (Lux) Equity Fund2.

All market investments are subject to some risks. The question to ask oneself, is the VIE risk real?

Reason III - Fierce competition

Despite its revenue growth, Alibaba has faced unprecedented competition in recent years. Pinduoduo, Douyin, and Kuaishou have gained immense popularity in recent years due to the rise of social commerce and short-video commerce. In 2021, Alibaba's average customer acquisition cost was 477 yuan (~$65 USD), nearly six times higher than Kuaishou's.

Additionally, Temu, a newcomer in the e-commerce scene, has been gaining popularity rapidly. This has put pressure on Alibaba, the established player, as it now has to compete for attention. Temu though has been facing complaints about undelivered packages, mysterious charges, incorrect orders, and unresponsive customer service. All this said, Temu’s business model, if successful, and more importantly IF economically viable, could disrupt the global supply chain and have major implications for U.S. retailers. This could force Alibaba to adapt its strategies to stay competitive.

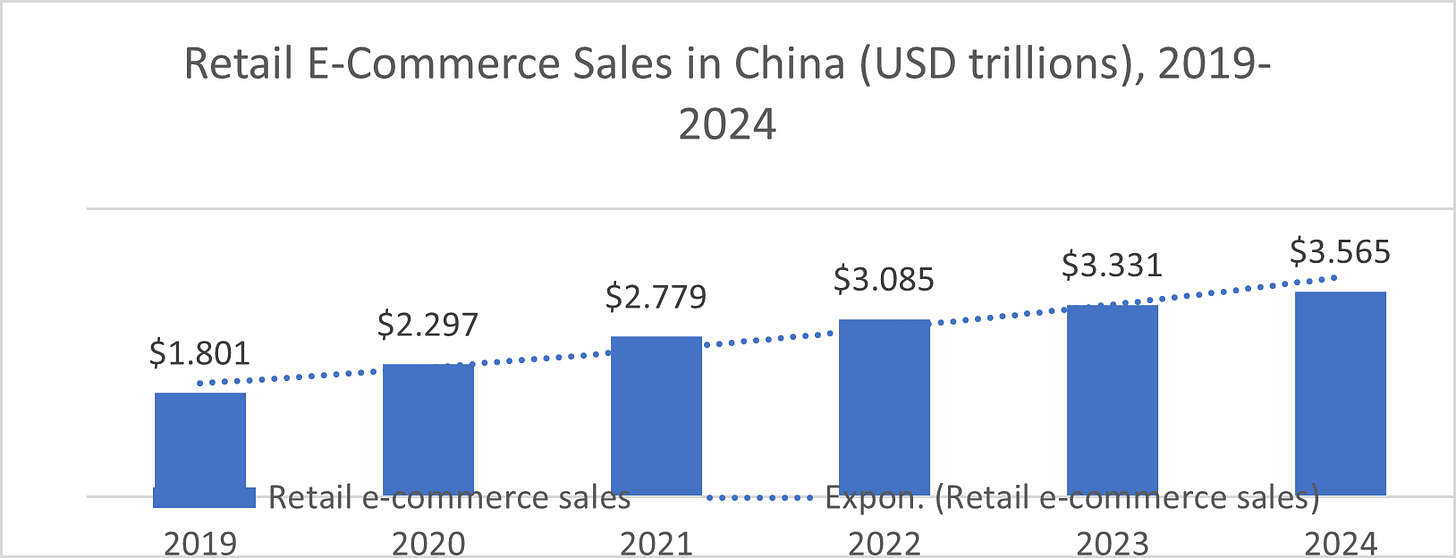

Alibaba though is the largest e-commerce panda and will take a lot of little ones to displace this cozy spot. It also boasts a diverse revenue stream, most of their competition does not. Do not trust me, see what these folks at Statistica have put out. Over a third of the revenues DO NOT come from China commerce and the other segments are fast growing.

Reason IV - Because the old guy bought it

There is this site called Dataroma where you can sneak up and see what the investment legends are up to. Anyways the late (and revered) Charlie Munger did nothing for a decade and got up one day and bought BABA. He since has admitted it to be his biggest mistake and has not sold (except when he was tax-loss harvesting) stating “I regard Alibaba as one of the biggest mistakes I ever made. In thinking about Alibaba, I got charmed by their position in the Chinese internet and didn’t stop to realize, ‘they’re still a gawd-damned retailer.’” I, along with many other Munger-fanatics jumped the train and since then have been averaging down or depending on how realistic you want to be ‘have been catching the falling knife.’ Regardless of the words, his actions said otherwise. He never sold. Ironically, the Poor Charlie’s Almanack warns against the psychological errors in human judgement, with social proof topping the list attributing credit to Dr. Cialdini’s research

Reason V - Chinese policymaking and slowdown

Arguably one of the most interesting social experiments in recent history is the implementation of China’s one-child policy. China introduced the one-child policy in 1979. The official start of implementation came in 1980, with an open letter issued by the Central Committee of the Communist Party of China. This policy was introduced to control population growth. It was phased out in 2015.

I had lost the crown as the best debater back in my undergrad and I was sulking for a good part of a year for it. ‘Should India follow the footsteps of China and implement the one-child policy?’ Believe it or not, with the context of India and my limited ability to employ geometric progression, I was tasked to argue against the motion and lost. A few decades later, this has resulted in no consumers for Alibaba. Other consequences include an aging population in upcoming decades, risk of population reversal, and not knowing what the angst of having a younger sibling is.

China introduced several policies to limit the time youth spend on screens gaming, curb edTech firms charging astronomical fees to families with aspiring students and levied fines to put their tech firms in check (in many ways similar to EU countries summoning tech companies that they can’t build on chips they can’t afford.) China also had some strategic mis-steps, one resulting in a real-estate bubble (similar to the one seen in the western world in recent history.)

We can paint the analogies in broad strokes or we can argue about the nuances. Yet, numbers don’t lie and below are some numbers. These were pulled from the US International Trade website. Quiz me this - which year do you see the slowdown?

I hope I have made a strong case for you to stay away from this equity. If that wasn’t convincing Alibaba has seen changing leadership over recent years, paid record fines during the tech crackdown, started issuing dividends (a proxy admission of slowing growth), issued convertible bonds for share buy-backs (as an acknowledged financial engineering move to revive sluggish performance) and if that wasn’t enough, what is your view on Taiwan?

A quick note on the bull case

Alibaba is the only tech company that has meaningful Cloud and AI offerings in the region (and globally). For comparison, Amazon, Tencent and Microsoft are cloud-heavy shops. Meta has AI, but lacks cloud offerings. Google is the only player, besides Alibaba that boasts both capabilities but struggles on the enterprise-adoption front. It also helps that is is also the cheapest tech giant in the Fortune 100 list.

It has 10x the revenue when compared to its IPO and the market cap is less than the IPO valuation at the time of this writing (~82%). This debt-lite business has a significant double-digit % of EV (Enterprise Value) as cash position to deploy towards the next big bet (>50B USD at the time of this writing). The firm is committed to retiring at least 3% of shares each year for the next few years to shareholders and paying about 1.5% in dividends.

Here are a few things you get in pride as the owner of Alibaba. (Needless to say, pride is all you got for owning this stock for a decade.)

Alipay: Revolutionized online transactions, building trust with one of the world’s largest payment platforms.

Cainiao Network: Enhanced e-commerce with a data-driven logistics platform for faster, reliable delivery.

Ele.me: Entered the on-demand delivery market, enabling doorstep delivery of meals and goods.

Innovative Retail: Coordinated all retail functions online into a data-driven network, outpacing traditional business infrastructures.

Record-Breaking Sales: Demonstrated strong market presence with record sales during events like China’s Single’s Day.

Venture Capital and Investment: Showcased financial strength by becoming one of the world’s largest venture capital firms and investment corporations.

AI and Technology: Committed to R&D of AI and other technologies, staying at the forefront of industry advancements.

Digital Media and Entertainment Group: Diversified into media and entertainment-related businesses within the Alibaba ecosystem.

Alibaba Cloud: Revolutionized the entertainment industry with a secure, dependable, flexible, and scalable cloud-based platform.

Innovative Business Model: Applied its innovative business model to its media business, making it faster, smarter, and more efficient.

At the time of this writing 18% of my liquid net-worth is in the company. I expect to hold it for many decades and you would buy it at 27% discount to my cost basis at current levels. I continue to be bullish (read stupid) about this bet. So far counter points to my investment thesis have been limited. They remind me of the saying about the region. “There seems to be no curbing of free speech here. If it exists, no one has ever mentioned it.”

Thanks for sticking by. Want more? Listen to me ramble about this here.

Well researched .