Reasons NOT to own what I own - Part II - Tencent

Not really stock advice, just collation of my learnings

Part of my challenge is adapting to all other humans. Another part is to sound dumb and repetitive as I remind you all that reader skepticism of this article is heavily encouraged as the author presents a biased view of his favorites and this writeup is NOT to be construed as a BUY, SELL or HOLD decision. I am not your tax, accounting, investment or financial advisor. I am definitely not your tarot card reader or personal shopper.

The below writeup is about Tencent, and since we are dealing with the same region, please look at this BABA writeup if you want some additional regional and cultural context. With that said, lets get started.

Reason I - They have over a billion users

One trite stat that toddlers scribble with crayons is that every fifth or sixth person in the world is Chinese. 75% of them are active users of the WeChat app, that is 100% of them with a phone or anyone living above any rock. On average these users generate about $65 in revenue per year which is about twice of that of offerings by Meta (this includes their family of apps - fb for gramps, insta for your hip aunt and messenger app to sell your patio furniture that you never used to its next creepy owner.)

If Elon had his way, he would be happy with X having a 10th of the superapp clout that Tencent boasts through WeChat. In this ecosystem you can share images, post videos, host livestreams, pay friends, borrow credit, host businesses, buy food, movie tickets, engage with customers, browse, chat and also do whatever you can do on x, fb, and insta combined. This is the top downloaded app, most used app, largest revenue generating app, largest data flow app for anyone that speaks mandarin or cantonese as their primary language or wants to live in the region. Owning tencent is like charging a survival tax on its users.

On the downside, everyone who can be a customer is already a customer. Where is the growth in that? IDK, ask the META owners. Similar dilemma, with half the revenue (per user).

As the authors of Empty Planet - The Shock of Global Population decline write “The great defining event of the twenty-first century—one of the great defining events in human history—will occur in three decades, give or take, when the global population starts to decline. Once that decline begins, it will never end.” This is bad for businesses. If you are a shareholder of any company, go out there and ask your friends to make some babies. Take tips from desi relatives or Elon on how to have that conversation.

Reason II - They are a holding company

When bankers, corporate offices, and private equity discuss mergers and acquisitions on bumpy golf carts as they pull out the pinky to show the chutes of their expensive champagne, they discuss “synergies” of some deals. In reality, biases and individual incentives do not always line up with value creation. I have been fortunate to to be a long-lived fly on many walls where this is discussed. In many cases, M&A activity is ego-driven and centers around empire building.

Here is hard data. Naspers owns Prosus, which owns Tencent, which owns a whole slew of companies that are compiled here.

Point is if you have owned any holding company in any region (Alibaba(China), Fairfax(Canada), Bajaj(India), Efes(Turkey)) you probably know what I am talking about. Another example is Just Eat Takeaway.com is a holding company that owns popular food delivery brands like Just Eat in the UK and Grubhub in the US.

There maybe many reasons including complexity, transparency, double taxation of dividends, costs of decoupling (by the same management, attorneys, bankers after the ‘synergies’ they originally proposed fail). Concerns around capital allocation, governance, focus and expertise of leadership are some of the reasons why the sum of parts is limited to mathematics, computer science and physics, in ideal conditions. It rarely lines up in finance but if you are starting a serious business in Asia or Africa, you will likely knock this door for VC money.

Reason III - They make video games

Parent readers, fix your babies’ car seats as I take you through the ways in which Tencent will monetize you as you distract yourself from your parenthood. For the kids, we have another set of distractions as they opt-out as proxies from whatever social games you deploy them to play for you.

Since we all seek distractions till we die, Tencent wholly owns major game developers and publishers to serve us. These include:

Riot Games (100% ownership) - developer of League of Legends

Supercell (84% ownership) - developer of Clash of Clans, Clash Royale

Grinding Gear Games (80% ownership) - developer of Path of Exile

Sharkmob (100% ownership)

It also has significant minority stakes in many other leading game companies globally, including:

Epic Games (40% stake) - developer of Fortnite

Activision Blizzard (5% stake) - that game Diablo that gave you carpel tunnel?

Ubisoft (5% stake) - action-adventure franchises like Assassin's Creed and Far Cry

Frontier Developments (9% stake) - sims like Planet Coaster and Jurassic World

Paradox Interactive (5% stake) - historical and sci-fi settings like Crusader Kings, Europa Universalis, and Stellaris

Glu Mobile (15% stake) - Deer Hunter hunting games and celebrity/lifestyle games like Kim Kardashian: Hollywood

Discord - Undisclosed stake but ironically banned in China

The challenge with video games is that China has limited their use and the world no longer lives in bunkers as it did in the pandemic. I always struggle to find folks to play AOM with. If you you are one of them, hit me up.

Reason IV- They trade as a pink sheet

Tencent does not have a direct listing on major U.S. exchanges like the NYSE or Nasdaq. To allow U.S. investors to trade Tencent shares, the company's stock is available over-the-counter (OTC) in the form of an unsponsored American Depositary Receipt (ADR) with the ticker TCEHY.

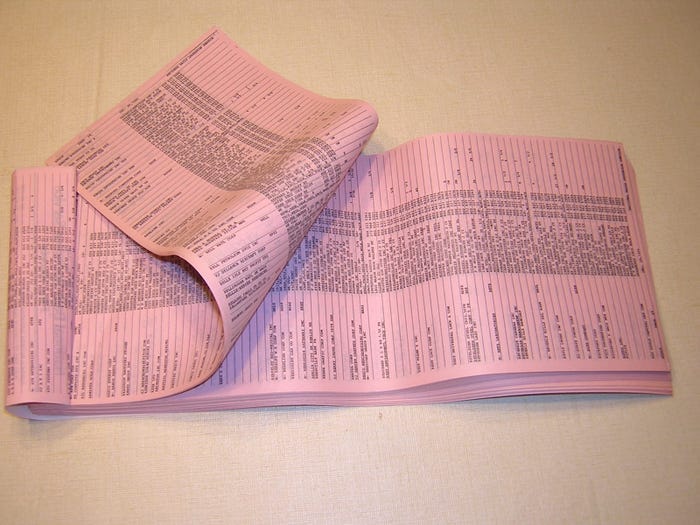

Pink sheets refer to the listing service for stocks that trade over-the-counter and do not meet the requirements for listing on a major U.S. exchange. Trading on the pink sheets allows companies like Tencent, which is based in China, to have their shares available to U.S. investors without going through the process of a full U.S. exchange listing. What would they be possibly be hiding to avoid a more stringent scrutiny?

This probably is the largest company to exchange hands via pink sheets. Pink sheets are commonly known as penny stocks and get their name as they were originally printed on, well, pink sheets of paper. (Yes you, dear reader, are a genius for guessing that bit.) Nothing about this company resembles a penny stock in any regards though. It is almost as if they do not want to be noticed. It is loosely similar to Google or Meta calling themselves a tech company and not an advertising business to avoid scrutiny of regulators. Again, what could they possibly be hiding? Or who are they hiding from?

Reason V - They are low on charisma

As a money printer in China, Tencent and their leader go out of their way to stay out of the media. Have you heard of Jack Ma? Have you heard of Pony Ma? The dude had to go through a very complicated back surgery. Did you know about that? No! You only think about yourself. Musk and Zuck can challenge one another all they want but they both secretly wish they were Pony Ma in the super-app world. Anyways, you can’t really own a gaming empire without trading your back and you can’t really hype the market when you fly under the radar. But you can definitely buy your own stock cheap when no one is watching. And Tencent cannibalizes its shares like it is literally nobody’s business. Existing share holders have to do nothing to own more and more of the business, their stakes continue to grow as they game their hearts away. As for the pink sheets, Pony buys them all when there is blood on the streets, he likes it best though when there is no one on the streets. What a loner though! Wish he found his Balmer.

Conclusions

Would like to iterate, I hope you draw your own conclusions but if it matters 12.5% of my net-worth is deployed here with a cost basis of $34 and change. As an armchair pseudo intellectual, I have no reservations investing in the region. If you like a VC that owns a major slice of the world’s gaming and social media empire, Tencent is second to none. It hires the best STEM students globally, pays them envious amounts of money and it prints billions and I plan to hold it for a long long time. If you harbor animosity towards people in the region, what better way to punish them than to charge a toll on their existence. As their former leader once said, “It doesn't matter if the cat is black or white as long as it catches mice.” Then they went ahead and pulled a billion people out of poverty. The world is still in denial. They call it socialism with Chinese characteristics. Personally, I don’t lean red or blue or even orange for that matter. I lean green. Please don’t lynch me just yet.

Did I forget to offend any particular group? Next time. The Balmer dance is making me dizzy now. Maybe we will dissect that empire next.

Like this? Here is part I of the series.

Well covered and thanks for sharing.

And yes we do still play AoM.

Long long time is the right answer for holding period. Trillion dollar plus company potential for sure.