Reasons NOT to own what I own - Part IV - Kazaki superapp

Happy holidays! Please hit unsubscribe below, if you do not wish to receive these.

Act like a king or a queen and consult your own trusted advisors- financial, legal, spiritual, members of the kin or clan before you dabble into the games of wealth. Please don’t take advice from strangers on the internet! Reader skepticism is encouraged as the author presents a biased view of his favorites and this writeup is NOT to be construed as a BUY, SELL or HOLD decision. But if you want to take a good lesson on leadership, check out the video above. Before that, let me share some context.

This post is part 4 of a series which makes a case to my friends, family and loved ones to NOT own what I own. With that, hold onto your hats, folks! We’re diving into the exciting world of the Kaspi superapp, a true gem in Kazakhstan’s digital landscape that's got me excited! Why is it so special, you ask? Let’s break it down! But first, spot Kazakistan on an empty map. Next, ponder about why you are so ignorant. Finally, let’s get to it.

Reason 1 - Corruption and Bureaucracy

Kazakhstan is plagued by high levels of corruption, particularly in public procurement and customs administration. Bribes and irregular payments are common, creating a challenging environment for businesses. Companies often face bureaucratic hurdles and vague legislation that complicate foreign investment, with many reporting corruption as the primary constraint to doing business in the country. You should stay away too!

Reason 2 - Economic Vulnerability

The Kazakh economy heavily depends on oil and mineral exports, making it susceptible to global commodity price fluctuations. This reliance poses risks during periods of declining prices or demand, which can severely impact economic stability and growth prospects. Additionally, the ongoing geopolitical tensions, especially related to Russia, further complicate economic conditions and investor confidence.

Reason 3 - Regulatory Uncertainty

Investors face an unpredictable regulatory environment, with frequent changes in policies that can adversely affect foreign capital. Issues such as unplanned taxes and currency controls add to this uncertainty, making it difficult for investors to navigate the market effectively.

Reason 4 - Infrastructure Challenges

Kazakhstan suffers from chronic underinvestment in infrastructure, which hampers economic development. This lack of focus can limit project potential and increase operational costs for businesses looking to invest in various sectors.

Reason 5 - Inflation and Economic Slowdown

Recent forecasts indicate a slowdown in economic growth, with inflation remaining a concern. Although inflation is projected to decrease gradually, the overall economic outlook remains uncertain due to various internal and external factors affecting growth. Yes, I am still talking about Kazakistan.

I don’t even know how a few people read beyond this point but I typically go to un-fished territories ponds so that I can put the “wild-caught label”.

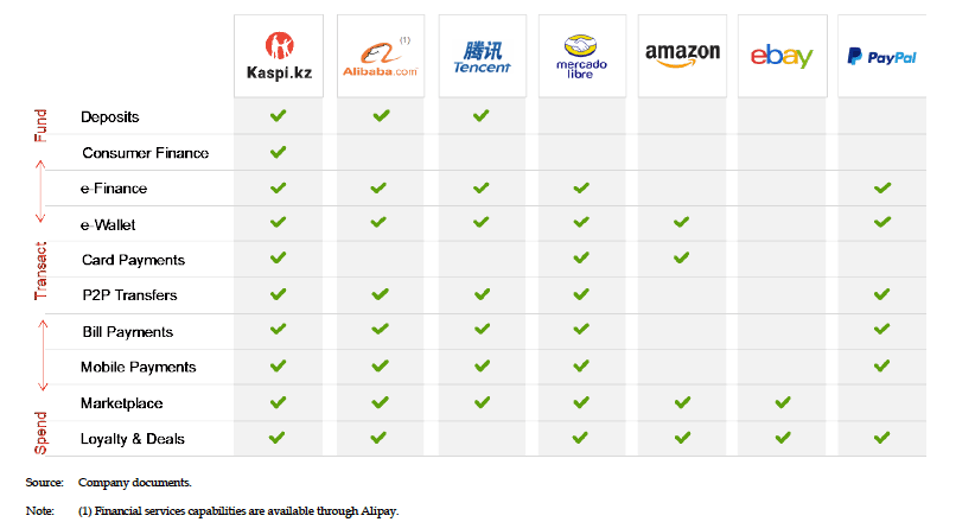

WeChat (from Tencent) got a cousin in Central Asia

Imagine an app that does it all—payments (think Square), e-commerce (think Amazon), banking (think Sofi), and even government services (think digital DMV and more)—all rolled into one! Kaspi is like the Swiss Army knife of apps, capturing a huge slice of consumer spending in Kazakhstan. With around 70% of the population already using it, they’ve created a sticky ecosystem with no real competition.

For the other apps, Kaspi is like that nerd in class that they hate who just keeps getting better! With plans to expand beyond Kazakhstan and the founders owning 44% of the company, this app is on a growth trajectory that’s hard to beat. Plus, it boasts impressive margins—think 40% net income!

Half of Kazakis as their DAUs

With about 10 million daily active users (that’s roughly 70% of its user base), Kaspi is always buzzing with activity. Payments are their bread and butter, but they’re also making waves in e-commerce and fintech. And guess what? Users love it! They’re so committed to keeping things top-notch that if a service doesn’t meet their high standards, they’ll ditch any feature that doesn’t make the cut.

The Payment Powerhouse

Let’s talk payments. Kaspi has made QR codes and cards super popular—80-90% penetration among users! (For readers from India, this is their PayTM. Venmo for Americans. Interac for fellow cannuks.) They’ve got a whopping 700,000 merchants on board and are seeing transaction volumes grow by 30-40% per annum. That’s some serious cash flow growth!

eCars to eGroceries and everything in-between

The marketplace segment is where the fun really begins. With e-commerce still growing in Kazakhstan, Kaspi is adding new services like e-grocery (think Amazon Fresh) and e-cars (think Carvana) to keep things fresh. Revenue here is skyrocketing—over 70% growth!

Lenders for consumers AND small businesses

In the fintech corner, Kaspi is offering buy now, pay later options and general loans. They’re even helping small businesses with financing. As interest rates start to drop, things are looking bright for their profits!

eGov Services

Kaspi isn’t just about making money; they’re also helping the locals. They provide free government services that make life easier for everyone—from tax filings (think TurboTax) to business registrations (think ). I wish I had something like this for the regions I have lived in.

Meet the Dream Team

Leading this charge are founders Vyacheslav Kim and Mikheil Lomtadze, who have turned Kaspi from a small bank into a superapp sensation. Lomtadze has navigated through tough times including political upheavals and economic challenges—and he’s been named the #1 CEO in Kazakhstan for years running! They are billionaires now who have listed this company in Nasdaq and London. Now go back to the video we started with!

In Conclusion

Kaspi isn’t just another app; it’s a powerhouse that’s transforming Kazakhstan's economy while making life easier for its users. It has single digit multiples, over 7% dividends, highest margins in software, highest growth prospects. People shy away from Kazakistan, if they know about it. IMO, they wouldn’t, even if they really knew about it!

See others in this series below:

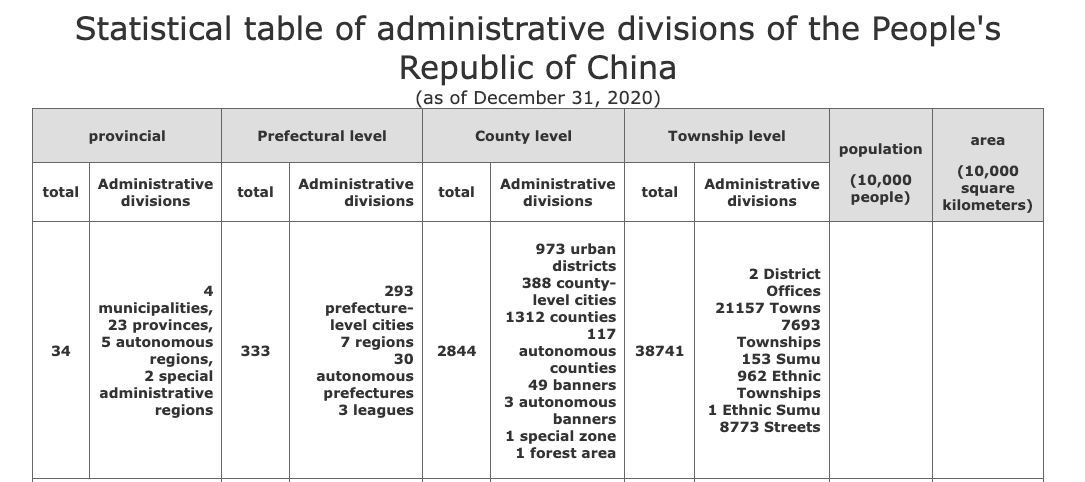

Reasons NOT to own what I own - Part I - BABA

This is an attempt to articulate the rationale behind all my current holdings starting with my oldest, largest and at the time of this writing, my least successful holding by all measures… BABA. Reader skepticism is encouraged as the author presents a biased view of his favorites and this writeup is NOT to be construed as a BUY, SELL or HOLD decision. I…

Reasons NOT to own what I own - Part II - Tencent

Part of my challenge is adapting to all other humans. Another part is to sound dumb and repetitive as I remind you all that reader skepticism of this article is heavily encouraged as the author presents a biased view of his favorites and this writeup is NOT to be construed as a BUY, SELL or HOLD decision. I am not your tax, accounting, investment or fin…

Reasons NOT to own what I own - Part III - Turkish Insurance companies

My closest friends do not trust me with the choice of ice cream toppings and never risk saying “Surprise ME!!” as they look for parking. You shouldn’t be looking for any insights from such a guy. Reader skepticism is highly encouraged as the author presents a biased view of his favorites and this writeup is NOT to be construed as a BUY, SELL or HOLD dec…

Listened to 3 interviews of the founder and found him to be shareholder oriented, focused, and down to earth. My type of guy. Hope they crush it outside of Kazak.

Excellent