What I learned about investing from Darwin? A summary

The Mahabharata is an epic that is rarely taught to young kids in India because it encompasses themes of incest, gender change, property disputes among family, children born out of wedlock, lust, deceit, ego, betrayal, jealousy, gambling, and the killing of one’s own kin. Yet, it also exhibits exemplary acts of loyalty, honor, discipline, respect, strategy, generosity, valor, and sacrifice. People often opt to teach the Ramayana because it presents an obedient son and an ideal king, who, by all modern-day feminism standards, is a disappointing husband and an absentee father. He conveniently prioritizes societal norms and his parents over his personal responsibilities and pleasures.

In the closing act of his seminal book, Pulak mentions this epic that originated in 400 BC, boasting 1.8 million words. This makes it seven times the length of the Iliad and the Odyssey combined.

The wise king, Yudhishthira, goes through a grueling Q&A with Yaksha, a powerful demigod, in a bid to resurrect his brothers. A myriad of armchair philosophy questions later…

Yaksha asks: “What is the greatest wonder in this world?” Go ahead, give it a thought…

Yudhishthira replies: “Everyone sees countless people dying every day, yet they act as if they are going to live forever.”

Pulak’s genius draws this analogy into the investing world and answers the question in the context of investing: “Everyone sees immeasurable wealth being created by people who never sell, yet they think and act as if selling creates wealth.” (He cites the Fortune 100 list of richest people as evidence.)

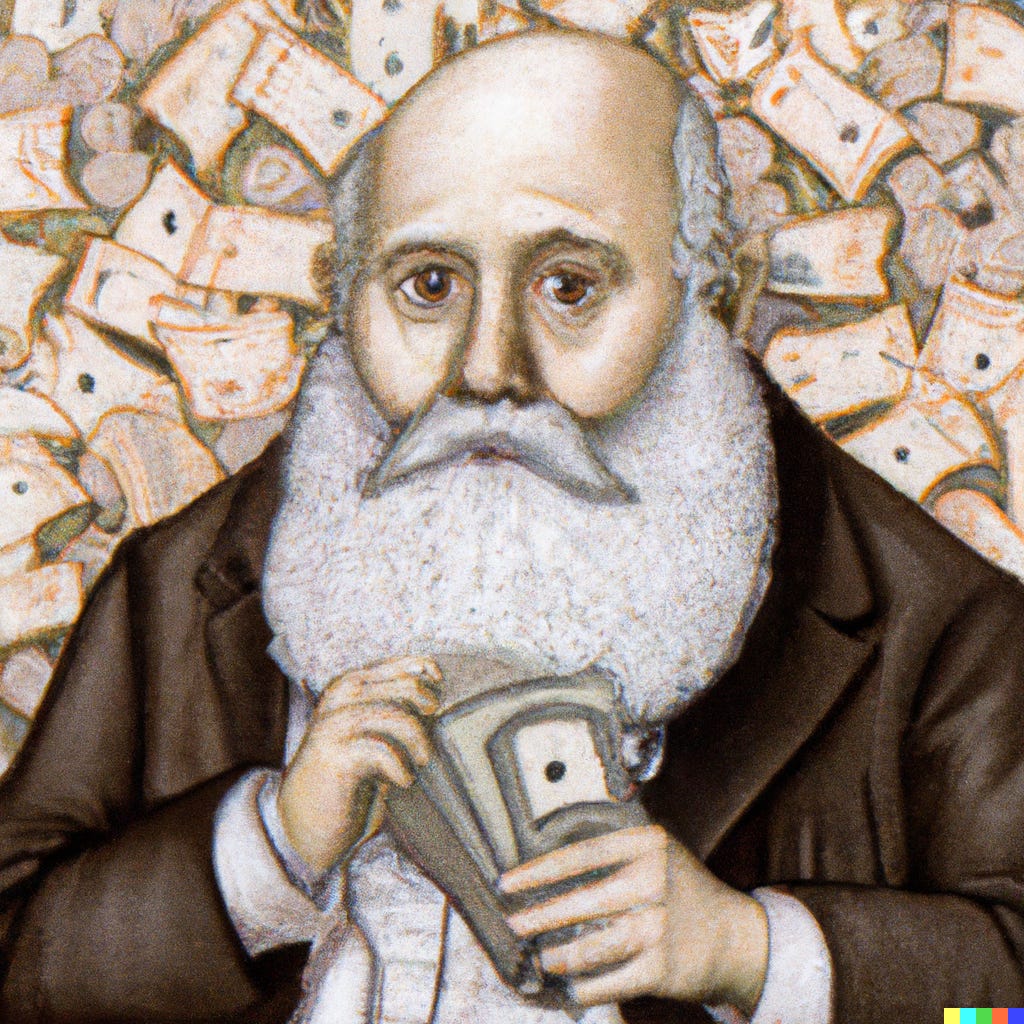

The book presents concepts through the democracy of dancing bees, the breeding habits of rabbits, deceptions employed by dung beetles and frogs, hierarchies among deer, and Charles Darwin’s theories to explain three simple concepts that led to the spectacular success of the hedge fund he runs with his team:

Eliminate significant risks.

Invest only in stellar businesses at a fair price.

Own them forever.

One cannot summarize a classic, and this book undoubtedly qualifies as such. If you need to borrow this book, just give me a holler, and I’ll happily send my copy your way.

More from Urban Malgudi here. You may also like some of these popular posts related to investing:

Intelligent Investor — Summary

Investing in high growth economies

Retail investors pre-purchase checklist