The Intelligent Investor — key takeaway, masala pack

The Intelligent Investor — key takeaway, masala pack

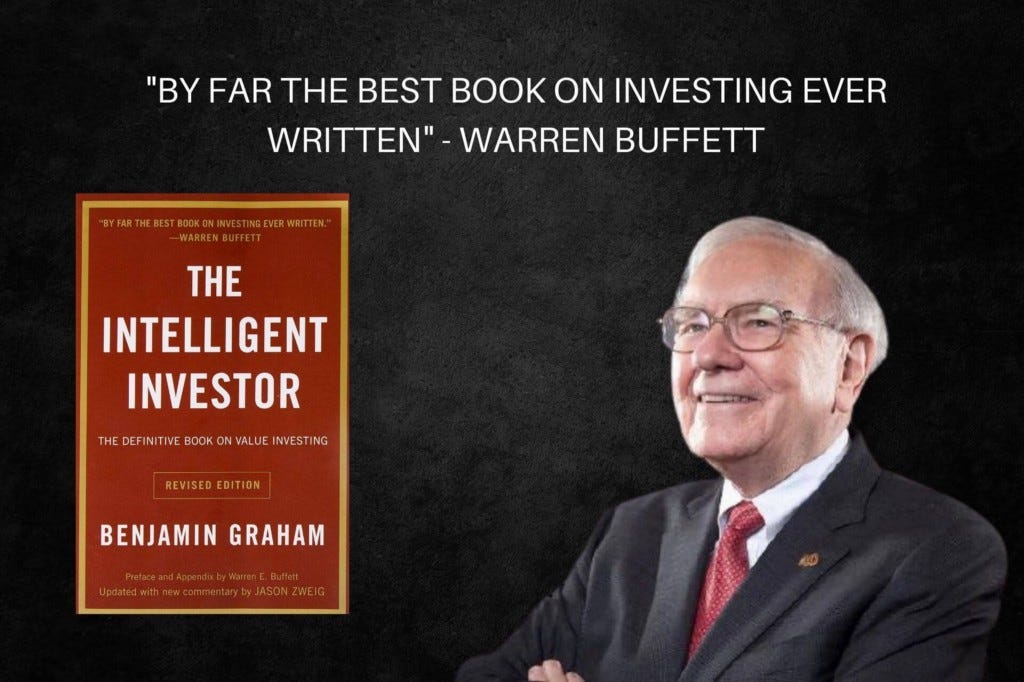

Gather around with some pop corn, and butter it up. And allow me introduce you to the OG hedge fund manager, Ben Graham, polyglot, academic, author, teacher and mentor to none other than Mr. Warren Buffett, who recommends just one book on investing called, The Intelligent Investor, that is almost a century old.

Buffet jokes that “You can’t teach a new dog old tricks” and there is some profound wisdom to those words. If a problem is old, the older the solution, the better. (Think yoga or any religious or philosophical text of your choice.) Older solutions and frameworks grow stronger as they prove value over time and it is definitely true about value investing, a concept first introduced in this book.

Lesson 1: Difference between value vs. price; Speculation vs. investing.

Imagine you have a farm that your great grand father bought and you got like one 30th part because birth control wasn’t widespread and people had fewer things to distract themselves with in the bottomless abyss we call existence before TikTok came along.

Let us say your share is worth $10000 dollars (Intrinsic Value) and in a good year it can produce about $1000 worth of marigold flowers (Earnings) that are sold once a year to decorate nearby urban neighborhoods as the country celebrates the homecoming of a largely patriarchal sexist but righteous god-son of an religion while tipping the nation towards chronic diabetes and obesity. (More here.)

But you are far far away and your distant cousins mostly steal the crop that causes you a lot of heartache. One peculiar weazel comes to you and offers $8000 (Ask Price) every day of the year. Year after year. You have run out of ways to politely turn him down. This goes for a while but after few sad moonshines, you get a tax bill and you really seem to need the money. You call your old cousin and say, “How about $9000?” (That is the Bid Price.) You both settle on $8500.

Your cousin got a good deal. Price is what they paid ($8,500) and value is what they got ($10,000). Their margin of safety was $1,500 or 15%.

Margin of safety = Value — Price.

(But this is the last time your cousin rips you off. Next time, do not buy anything, a stock or a table unless you are getting a respectable margin of safety. In other words, you know that you should get more value than what you pay for in price. Intrinsic value can be functional, emotional or financial so two intelligent individuals can arrive at a different value with the same information but different assumptions. (Financial) intrinsic value can be calculated using DCF (Discounted Cash Flow) or FCF (Free Cash Flow) calculations, which are logically very similar to mortgage estimates on a car or house or calculating interest.)

If you have a good opinion about value, price and margin of safety of what you buy and own, you are an investor, else you are a gambler or a speculator.

Lesson 2: Mr. Market is a bipolar depressed maniac

Now we are decendent of apes. We like to admit that less often to never but we ape each other a lot. Knowingly or unknowingly we seek social proof. If a bunch of us get happy, we risk a financial orgy and everything in the market becomes very expensive and oddly enough we cheer high prices. We never do that if oil goes high or our vente mocha suddenly costs us 40% more. But when it comes to buying assets we think more expensive is better. I am certain a few alien researchers are scratcing their heads observing this Earth vivarium. It is mind boggling how many people will be willing to pay more when a stock rises, vs. when it falls.

Mr. Market is a metaphor that Graham created that I will help you visualize. Close your eyes. Ha! Imagine all the monkeys who own different kinds of dried fruit enterprizes cuddled over one another, wearing a custom-tailored jacket purpose-built to fit them all and they hop along to you everyday to offer different prices by the hour. Apple $150, Banana $420, Apricot $160. Over the course of the year they will offer you the exact same thing (in most cases) for 2x, 3x premiums or 50, 80% discounts. On some days, all the monkeys will be extemely happy and quote ridculuosly high prices under the fascade of the suit they are wearing as Mr. Market, they might even polish their shoe or two but will offer the exact same goods.

On other days they will all be depressed about the pattern of the clouds on the east side of the mountain, a random forest fire or some alpha-baboon snorting coke or flinging feces a few oceans away. On these days Mr. Market will offer heavy discounts. Broadly speaking the forest is here to stay. This bipolar depressed maniac of Mr. Market is here to serve you. Buy on the days he is upset!

Lesson 3: Investing as a defensive (or passive) investor

If you buy specific amounts of a slice of everything Mr. Market has to offer every specific time period, you will beat every chimp who stares at candles or studies the pattern of the stars or involves in any form of short or long term fortune telling. You can do this by simply buying a low cost index fund once every paycheck. As eccentric as a group of monkeys maybe, know they have over time tamed wolves and sabre-toothed-carnivores and turned them into living couch pillows and built the internet to share their pictures.

There is some wisdom in the crowds. If the market is high, you inevitably buy a small slice relative to when market is low and there are no emotions involved in passive investing. Just by doing so, you will beat Wall street and Dalal street alike. This has been publicly proven in a public arena of a bet worth a million dollars by none other than Mr. Buffett (see below).

Lesson 4: Investing as an enterprising (or active) investor

It has been established that beating the market is difficult. Very difficult. only handful of people on the globe have done that for decades. But one peculiarity of the apes is that they tend to think that they are better than the other apes. By definition, this can’t be true and Graham strongly recommends investing defensively. But let say you want to get a kick out of the battle of wits played globally and try outperforming the world. Let us say you are an evolved ape, better than the rest, a special snowflake, a special kind of ape. Then, Graham hopes you have patience, discipline, eagerness to learn, lots of free time and the ability to spot hidden P/Es (Price/Earnings) in single digits or less than mid-teens. In the above example of the inherited land the P/E was 10 for you when you started out and little less for your cousin (go calculate!).

Graham wants you to buy a dollar for less than a dollar or stuff which has a high margin of safety.

Lesson 5: Risk vs. uncertainty

Apes care about 3 things, fruits, social heirarchy and as Sheldon would put it, coitus. Now imagine a grandfather alpha ape, a little old, still kinky when not his wise self gets a little cozy with one of the new damsel that is the talk of the shrubs. It is uncertain that a new life will be born in the ape-tribe of this wild act. (God hasn’t been invented yet so there is no judgement and the act is literally in the wild but some apes begin to have opinions, nonetheless.)

It is uncertain how this will impact the rearing and upbringing of the other infant apes that are on the way and it is uncertain if this will at large be a positive outcome. Most apes confuse this uncertainity as a risk and start acting on those assumptions that this act might potentially distort the social heirarchy or food supply or try to predict the gender based on what they saw or heard and start buying and selling fruits in a frenzy over the next few months based on this info.

But another wise ape who induged in his voyeur-like tendencies knows that the alpha has a good-gene pool based on the past and the chimp-princess comes from a strong lineage and if something were to happen out of this act of love it will only benefit the tribe at large without any downsides of this seemingly one-off encounter. He evaluates the probability his friend getting to induldge in his vices again, a baby-monkey to be born out of the series of events and the implications of these encounters to the fruit collecting capacity of the tribe. He also plots a probability tree of unpredictable outcomes with his favorite stick on the ground and sees branches as not risky. When the entire town is selling all the fruit in a mad frenzy, he scratches his head in disbelief, buys them cheap and waits. Baby or no baby, come winter, he is soon going to be rich!

Uncertain, yes, risky, he doesn’t think so. And yes, there was a baby monkey. His best friend was a pig. Proof and video linked below.

This is a intellectually sloppy version of a true classic. The content within the OG while invaluable, is dry, dense and sometimes boring. I have distilled it for the TikTok generation. I am, but an ape. As West says “Thank you for wanting to know more today, than you did yesterday.”

More from bubbykin here. You may also like some of these popular posts:

Investing in high growth economies